Sustainable Investing Simplified: A Guide to Choosing the Right Platform

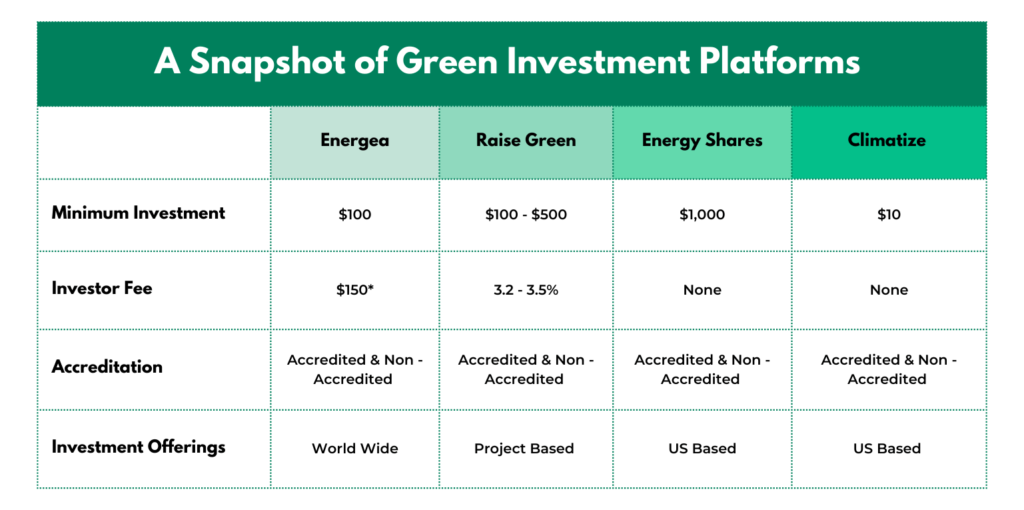

As the world shifts towards more eco-conscious investments, it’s essential to choose a platform that aligns with your investment goals and ethical commitments. This guide compares four sustainable investment platforms – Energea, Raise Green, Energy Shares, and Climatize – focusing on their unique features and comparing the usability of the platforms based on availability.

In the impending rise of green investments to curb our planet’s C02 emissions, there are a variety of platforms, funds, and stocks that you can invest in. We chose the following four platforms based on the sustainable investments that they offer. None of these platforms, as of this publication date, deal with carbon credits. This guide solely covers long-term investments in sustainable projects on platforms that may offer a competitive return on investment.

We’ve decided to analyze the platforms based on the features that we’ve found investors tend to care the most about when signing up, investing, and reinvesting. The following comparisons are not in order of importance.

Energea: Unlocking Global Solar Investment Opportunities

Energea presents an enticing opportunity for accredited and non-accredited investors looking to enter the solar project market. With a relatively low $100 minimum investment requirement, it offers accessibility to various individuals. However, a one-time $150 investor fee for IRA accounts may be considered a minor drawback for those focused explicitly on retirement investments. Energea’s global reach is a significant advantage, as it allows investors to diversify their portfolios by participating in solar projects worldwide. Energea provides a gateway to a greener future, enabling investors to make a global impact while enjoying favorable returns.

Raise Green: Sustainable Investing with a Fee Consideration

Raise Green caters to eco-conscious investors by offering sustainable and eco-friendly projects, products, and services. Open to accredited and non-accredited investors, it promotes inclusivity in sustainable investing. However, potential investors should be mindful of the variable investor fees, ranging from 3.2% to 3.5%, which could impact overall returns. Depending on the project, the minimum investment fee varies between $100 and $500, allowing investors to select opportunities that align with their budget and sustainability goals. Raise Green is an excellent platform for investors dedicated to making a positive environmental impact through their investments. However, it is essential to take into account the investor fees.

Energy Shares: Concentrated Solar Investing

Energy Shares offers a focused approach to solar investments within the United States, making it a suitable choice for investors who prefer a concentrated portfolio. It is open to both accredited and non-accredited investors, promoting accessibility. One notable advantage is the absence of an investment fee, ensuring that your capital is fully invested. However, the minimum investment requirement of $1000 may deter some potential investors with limited budgets. For those seeking to support solar projects exclusively in the United States and prefer a fee-free approach, Energy Shares offers an appealing avenue for sustainable investment, provided the minimum investment threshold is met.

Climatize: Accessibility and Impact in One Platform

Climatize shines as a standout platform in the sustainable investing landscape. With a remarkably low $10 minimum investment fee and zero investment fees, it’s exceptionally accessible, welcoming accredited and non-accredited investors. This accessibility, combined with solar projects available across the United States, positions Climatize as an ideal choice for those looking to positively impact the environment without breaking the bank. Its commitment to sustainability and accessibility makes it an attractive option for a wide range of investors, aligning with the values of those seeking to contribute to a greener future. In February of 2024 Climatize will be releasing an android version of their app along with an online investing portal later the same year.

Conclusion:

In the landscape of sustainable investment platforms, Climatize emerges as a notably attractive option, especially for those new to the field or seeking low-barrier entry points. Its zero fees, minimal investment requirement, and user-friendly iOS app make it a friendly choice for seasoned and newer eco-conscious investors. Whether starting small or looking to diversify, Climatize offers a compelling avenue into sustainable investing.

The limitations of Climatize’s iOS app are supplemented by the other investment platforms, Raise Green, Energea, and Energy Shares. Depending on your experience level and needs, those above are also great options that you can invest in based on your preferences for the type of project and your tolerance of investor fees.

Copyright@ Climatize Earth Inc 2023.

Copyright@ Climatize Earth Inc 2023.